Managing wealth can be difficult, especially if you have a huge portfolio. Between market volatility, inflation, and personal financial goals, it’s easy to feel overwhelmed. But there’s a solution that can simplify this: discretionary model portfolio services.

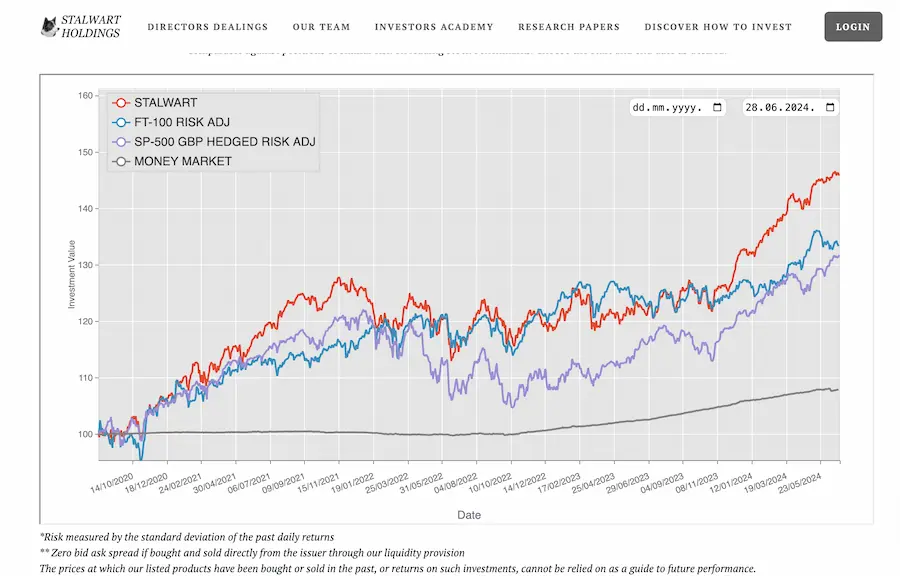

Services by Stalwart Holdings, can streamline your wealth management process and help you achieve your financial goals.

What Are Discretionary Model Portfolio Services?

Discretionary model portfolio services involve a professional wealth manager who takes care of your investments. They make decisions on your behalf, aiming to grow your wealth according to a predefined strategy.

This approach allows you to benefit from professional expertise without needing to manage every detail yourself.

Why Choose Model Portfolio Services?

Personalised investment advice is a key expectation for 74% of wealth management clients. However, it can be challenging to get tailored advice consistently.

This is where model portfolio services shine. They provide a structured investment approach, ensuring your portfolio is managed according to your specific financial goals and risk tolerance.

Stalwart Holdings, a model portfolio service provider, offers various strategies tailored to different investment needs.

Whether you’re aiming for growth, income, or a balanced approach, they have options to match your goals.

The Growing Market for Wealth Management Platforms

The demand for wealth management services is on the rise. The wealth management platform market is forecasted to reach $7 billion by 2026, growing at a CAGR of 14% according to industry statistics. This growth is driven by an increasing number of individuals seeking professional help to manage their finances.

Using a service like Stalwart Holdings model portfolio service can place you at the forefront of this trend, ensuring your investments are managed with the latest technology and insights.

Women and Wealth Management

Women are expected to control nearly $30 trillion in assets by 2030, industry reports highlighted. This shift signifies a significant change in the wealth management landscape. With more women in control of substantial assets, the demand for personalized and professional wealth management services is growing.

Model portfolio services can be particularly beneficial for women looking to manage their wealth efficiently. These services offer a structured and professional approach, allowing women to focus on their careers and personal lives while knowing their investments are in good hands.

Sustainable Investment Strategies

Sustainability is becoming a crucial aspect of investment strategies. Over 70% of wealth advisors are now focusing on sustainable investment strategies. This shift reflects a growing awareness of the impact of investments on the environment and society.

Stalwart Holdings incorporates sustainable investment strategies in its model portfolio services. This approach not only aims to generate financial returns but also to contribute positively to the world.

Revenue and Asset Growth

Wealth managers have experienced solid growth in client assets and revenue streams in recent years. This growth indicates a thriving industry, where clients are increasingly seeking professional help to manage their wealth.

Using a model portfolio service can help you tap into this growth. With professional management, your assets are likely to benefit from well-informed investment decisions, contributing to the overall growth of your wealth.

Navigating Economic Challenges

Since 2022, the economic outlook has been challenging. Increases in inflation, interest rates, and market volatility have created a less promising economic environment. Many wealth managers have faced weak net new asset growth and squeezed investment management margins.

In such times, having a professional manage your portfolio can be a significant advantage. Stalwart Holdings’ model portfolio service can help navigate these challenges, making informed decisions to protect and grow your wealth even in uncertain times.

Post-Pandemic Wealth Growth

The post-pandemic recovery has pushed global private client wealth to an estimated level between $320 trillion and $360 trillion as stated in the EY report for 2024. This surge in wealth presents an opportunity for individuals to invest wisely and grow their assets.

Model portfolio services can play a crucial role in this context. By leveraging professional expertise, you can ensure your investments are aligned with market opportunities and your personal financial goals.

Financial Market Trends

The decade after the global financial crisis saw an average annual financial market growth of 14% from 2012 to 2021. This impressive growth highlights the potential for substantial returns on investment over the long term.

By using a model portfolio service, you can position your investments to benefit from such market trends. Professional managers, like those at Stalwart Holdings, analyze market conditions and adjust portfolios to maximize returns while managing risks.

Final Thoughts

In today’s complex financial landscape, managing wealth effectively requires expertise and time. Discretionary model portfolio services, like those offered by Stalwart Holdings, provide a solution that combines professional management with personalized investment strategies.

Whether you’re dealing with market volatility, aiming for sustainable investments, or navigating economic challenges, these services can simplify wealth management and help you achieve your financial goals.

Related: